U.S. Expat Tax Filing Tips: Everything You Must Know

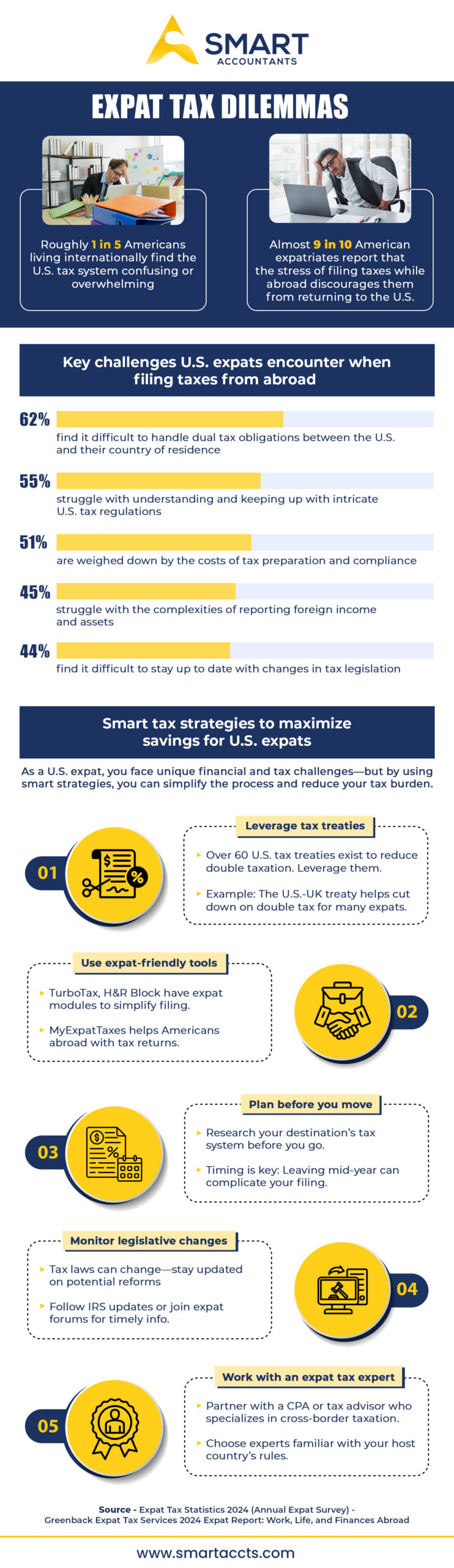

Understanding expat tax obligations is essential for U.S. citizens living abroad to avoid penalties and remain compliant with the IRS. Even while overseas, the requirement to file annual U.S. tax returns and report the global income remains the same. Staying informed, planning ahead, and using expat-friendly software or consulting a tax advisor can make compliance more manageable and help avoid costly mistakes.