Admin

Admin

4th Jun 2025

4th Jun 2025

The Smart Way to Go Global: Should You Establish a Foreign Subsidiary?

Going global is no longer optional—it’s survival.

As digital borders dissolve and global demand diversifies, companies with ambition are looking far beyond their home markets. But when the time comes to enter a new country, the question looms: Should we establish a subsidiary, or are there smarter ways to go global?

This blog breaks down the rationale, risks, rewards, and alternatives to help you decide whether forming a subsidiary is the right launchpad for your international growth.

What is a subsidiary — And how does it support global expansion?

A foreign subsidiary is a separate legal entity, incorporated in a country outside the parent company’s home country. It can be wholly owned or partially owned, but it operates under the laws and regulations of the host nation.

This structure provides a localized presence with operational independence, making it an attractive model for companies entering new international markets.

Why businesses opt for subsidiaries:

- Mitigated risk exposure — Legal and financial liability often remains confined to the subsidiary.

- Local compliance and access — Easier to secure licenses, hire staff, and open bank accounts.

- Brand localization — Businesses can adapt their products/services for cultural and regional relevance.

- Supply chain and operational efficiency — Businesses can operate and manage logistics directly on-site.

- Enhanced market credibility — Local customers and governments often trust businesses with domestic incorporation.

Benefits of setting up a foreign subsidiary

Let’s dive deeper into why many U.S. companies view subsidiaries as the preferred model for overseas expansion:

1. Tax optimization opportunities

Certain countries offer corporate tax incentives, free trade zones, or R&D credits to attract foreign investment. With the right planning, a subsidiary can:

- Lower the global effective tax rate

- Leverage double taxation treaties

- Strategically manage transfer pricing

2. Liability shield

Since the subsidiary is a separate legal entity, liabilities such as lawsuits, or regulatory penalties don’t typically affect the parent company. It also:

- Helps insulate the parent company from country-specific legal disputes or penalties.

- Any financial losses are usually confined to the subsidiary, protecting the parent’s assets, leading to risk containment.

3. Access to local capital and resources

By establishing a subsidiary, businesses can unlock key advantages that are typically reserved for locally registered companies, such as:

- Easier access to local funding through banks and investors who prefer working with domestic entities.

- Eligibility for government contracts that are only open to companies incorporated within the country.

- Better access to local talent along with incentives like hiring grants and wage subsidies provided by the government

4. Operational and strategic flexibility

A foreign subsidiary gives businesses the autonomy to adapt and thrive in the local market. With on-the-ground presence, they can:

- Launch region-specific product lines

- Customize marketing for local audiences

- Set pricing based on local cost structures

5. Improved supply chain control

Having a subsidiary close to the businesses’ suppliers, manufacturers, or customers allows for tighter control and greater efficiency across the supply chain. This help:

- Reduce shipping and transportation costs by shortening the distance between production and delivery points.

- Improve delivery speed with localized operations and faster response times to customer demand.

- Enhance coordination with local suppliers and partners for better inventory and production management.

The flip side: Challenges and risks to consider

While subsidiaries offer many advantages, they also come with challenges that can impact cost, compliance, and operational efficiency. Here are the main hurdles businesses should be prepared for:

1. Initial cost & capital requirements

Setting up a subsidiary often involves significant upfront investment such as:

- Legal incorporation fees, hiring professionals, leasing space, and HR setup costs.

- Some countries have minimum capital requirements for foreign-owned entities, which can be a barrier to entry.

2. Regulatory complexity

Operating in a new legal environment can be overwhelming. The issues can be related to:

- Navigating local laws, employment regulations, and industry-specific compliance requirements.

- Risk of non-compliance due to differences in legal frameworks, cultural nuances, or bureaucratic processes.

3. Accounting & reporting burdens

International accounting adds another layer of complexity. This includes:

- The need to maintain books under local GAAP and possibly convert them to U.S. GAAP or IFRS.

- Double reporting and transfer pricing documentation may be required for tax and audit purposes.

4. Profit repatriation issues

Moving profits back to the parent company isn’t always straightforward:

- Some countries impose withholding taxes on outbound profit transfers.

- Others may have currency controls or restrictions that delay or limit the repatriation of funds.

5. Cultural misalignment

Cultural gaps can hinder operations and brand success. This gap can be related to:

- Misunderstandings regarding local customs, business etiquette, or labour practices which can affect hiring, team dynamics, or negotiations.

- Poor cultural alignment which can damage brand perception or alienate local customers.

Smart Accountants offers end-to-end support, from regulatory compliance to financial reporting, so you can expand without the guesswork. Reach out to us today and let us help you establish a compliant, cost-effective, and successful global presence.

When is a subsidiary the right global expansion strategy?

Establishing a subsidiary is a strategic decision that makes sense under certain conditions:

- Long-term market commitment: If a company plans to operate in a foreign market for an extended period, establishing a subsidiary can provide the necessary infrastructure and local presence.

- Need for local control: When a company desires greater control over its operations, brand, and customer experience in a foreign market, a subsidiary offers the autonomy required.

- Availability of incentives: If the host country offers tax breaks, grants, or other incentives for foreign businesses, establishing a subsidiary can be financially advantageous.

- Industry requirements: Certain industries may require a local presence due to regulatory or operational needs, making a subsidiary the most viable option.

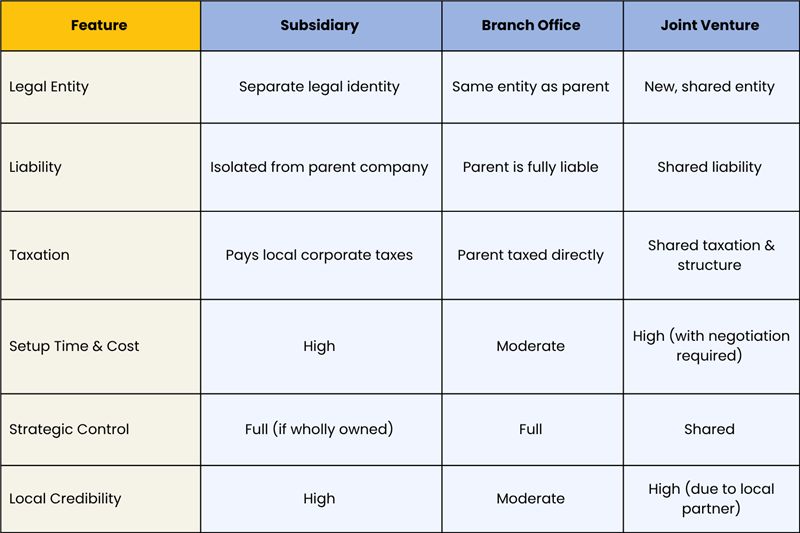

Subsidiary vs. branch office vs. joint venture: What’s right for you?

Before choosing to set up a subsidiary, weigh it against other expansion models:

Best use case for a subsidiary– You’re planning long-term operations in the market, want brand control, and need local infrastructure.

How to establish a foreign subsidiary

1. Conduct market feasibility study

- Assess demand, competition, legal environment, and consumer behavior.

2. Choose the right legal structure

- Options may include a limited liability company (LLC), joint stock company, or representative office.

3. Register the entity

- File incorporation documents with local authorities. This may include selecting a business address, director, and local representative.

4. Open a local bank account

- Required for tax payments and payroll management.

5. Comply with tax & employment laws

- Register for VAT/GST, corporate income tax, and social security schemes.

6. Hire local staff

- Either directly or through a local HR partner.

7. Set up financial reporting & compliance

- Ensure ongoing adherence to local financial standards, audit rules, and tax filings.

Conclusion: Is establishing a subsidiary worth It?

The answer lies in your goals!

If your company is committed to long-term international growth, with the capital and strategic clarity to go all-in, then establishing a subsidiary could unlock market dominance, brand loyalty, and regional scale.

However, if you’re in the early stages, navigating uncertainty, or testing the waters—starting lean with a partnership, or licensing deal may be the smarter way forward.

Subsidiaries are bold moves and in the right market, with the right vision, they can be brilliant ones.

Expanding Internationally? Smart Accountants Has You Covered.

Smart Accountants specializes in helping businesses like yours set up subsidiaries, manage compliance, and optimize international tax accounting strategy with ease.

Contact us today and take the stress out of going global.

FAQs

1. What is a foreign subsidiary in global business?

A foreign subsidiary is a separate legal entity established in another country to manage local operations while remaining owned by the parent company.

2. What are the benefits of setting up a foreign subsidiary?

Benefits include tax optimization, liability protection, local market access, better supply chain control, and enhanced brand credibility.

3. What are the risks involved in establishing a foreign subsidiary?

Risks include high setup costs, complex compliance, repatriation restrictions, cultural misunderstandings, and regulatory hurdles.

4. How does a subsidiary differ from a branch office?

A subsidiary is a separate legal entity with limited liability, whereas a branch office is an extension of the parent company with full liability.

5. When should a company consider forming a subsidiary?

When planning long-term operations, seeking local control, accessing government incentives, or entering regulated industries, company can go for a subsidiary.

6. How long does it take to set up a foreign subsidiary?

It varies by country but typically takes several weeks to a few months, depending on regulatory approvals and local legal procedures.

7. How can Smart Accountants assist with international expansion?

Smart Accountants helps businesses establish subsidiaries, navigate local regulations, and manage global tax compliance seamlessly.

8. Why choose Smart Accountants for global subsidiary setup?

Smart Accountants brings unmatched expertise in international accounting, tax planning, and regulatory compliance—helping businesses of all sizes expand globally with confidence. From entity formation to ongoing reporting, we simplify every step to ensure a smooth, compliant, and cost-effective expansion.