Admin

Admin

21st May 2025

21st May 2025

The Complete Guide to Business Cryptocurrency Transactions and Reporting

Cryptocurrency is no longer a speculative asset confined to tech enthusiasts or traders. With growing adoption, businesses across industries are beginning to integrate digital currencies into their operations, whether it’s for investments, transactions, or even payroll.

But with the emergence of cryptocurrencies comes the challenge of understanding how to account for them properly. Business owners need a solid grasp of cryptocurrency accounting to ensure compliance, mitigate risks, and maximize financial efficiency.

In this blog, we’ll explore what businesses need to know about cryptocurrency accounting, why it matters, and how to stay on top of evolving regulations.

Why cryptocurrency accounting matters

- Legal compliance: The IRS, HMRC, and other global tax authorities require businesses to report digital asset transactions accurately and in a timely manner. Failure to comply with these regulations can result in hefty fines, penalties, and damage to your business’s reputation. Proper cryptocurrency accounting ensures you’re in line with local and international tax laws, avoiding costly legal troubles.

- Audit readiness: As cryptocurrencies gain popularity, regulators are increasing their scrutiny of crypto transactions. To prepare for potential audits, businesses must maintain organized and traceable crypto records.

- Investor confidence: Transparent accounting practices foster trust with investors and shareholders. By providing accurate financial reporting for your digital assets, you show that your business is well-managed and that you’re taking proactive steps to minimize risk. This confidence can lead to increased investment and positive relationships with stakeholders.

- Operational accuracy: Understanding your crypto exposure improves decision-making and financial planning.

- Fraud prevention: Cryptocurrencies are vulnerable to fraud, mismanagement, and cyber threats. Implementing sound accounting practices, such as regular reconciliations, multi-signature wallets, and secure transaction tracking, helps prevent fraud.

Smart Accountants can help you stay ahead of compliance with crypto-specific reporting solutions customized for your business needs. Contact us today to get started.

How crypto is classified in accounting

Cryptocurrency doesn’t fit neatly into traditional accounting categories. Here’s how it’s typically treated:

- Not considered cash or cash equivalents by IFRS or GAAP standards.

- Usually classified as intangible assets (like trademarks or software).

- Not inventory unless you’re a crypto broker/dealer or exchange.

- Subject to impairment (loss in value) but not appreciation in most current accounting frameworks (in the U.S.).

- May be marked to fair value under proposed or jurisdiction-specific rules.

Key business use cases for cryptocurrency

Before you can account for crypto, you need to understand how your business uses it:

- Receiving payments in crypto (e.g., customer purchases).

- Paying vendors or employees in crypto.

- Investing in cryptocurrencies as part of a treasury strategy.

- Mining or staking crypto for rewards.

- Transacting with NFTs or blockchain-based assets.

- Using stablecoins (e.g., USDC, DAI) to hedge against volatility.

Core accounting principles for crypto

Cryptocurrency accounting isn’t just about recording a few Bitcoin transactions—it requires a structured approach rooted in traditional accounting principles, adapted for digital assets. These principles are the foundation for accurate financial reporting, tax compliance, and audit readiness.

Here’s what businesses must focus on:

1. Transaction-level detail

Every crypto transaction needs to be documented with precision, as each one could trigger a tax or accounting event. This includes:

- Date and time of transaction.

- Type of cryptocurrency used (e.g., bitcoin (BTC), Ethereum (ETH), USD coin (USDC).

- Quantity sent/received.

- Fair Market Value (FMV) in local currency at time of transaction.

- Transaction type: payment, investment, internal transfer, mining reward, staking reward, etc.

- Wallet addresses involved (for traceability).

- Blockchain transaction ID (TXID) for verification.

Example: If your business receives 1 ETH on April 1st when ETH is worth $3,000, you must record it as $3,000 in revenue—not just as 1 ETH.

2. Cost basis tracking

The cost basis is the original value of the crypto asset when acquired. It’s critical for calculating:

- Capital gains/losses when you sell, trade, or use crypto.

- Taxable income, when crypto is used in operations.

Cost basis methods commonly used:

- FIFO (First-In, First-Out) – default method for IRS

- LIFO (Last-In, First-Out) – allowed in some countries

- Specific identification – matching each crypto unit with its original cost (requires detailed record-keeping)

Pro Tip: If you’re using multiple wallets or exchanges, consolidate your data with crypto accounting software that tracks cost basis automatically.

3. Realized vs. unrealized gains/losses

Crypto’s high volatility makes understanding gains and losses critical:

- Realized Gains/Losses occur when crypto is sold, exchanged, or used.

- Example: You bought ETH for $2,000 and sold it for $3,000 → $1,000 realized gain.

- Unrealized Gains/Losses occur while holding the asset.

- Example: Your Bitcoin’s value increased on paper but hasn’t been sold → unrealized gain.

Under U.S. GAAP, unrealized gains on crypto cannot be recognized unless new guidance (like FASB’s fair value rule) is adopted. However, impairment losses must be recognized if the value drops and doesn’t recover.

4. Impairment testing (U.S. GAAP)

If you hold cryptocurrencies as intangible assets, they’re subject to impairment rules:

- You must evaluate for impairment at least annually, or more frequently if the asset’s value drops.

- If the asset’s market value falls below the recorded cost, the difference must be written down as an impairment loss.

- Impairments are permanent—you cannot reverse them if the value recovers.

Example: You bought 1 BTC for $40,000. If its value drops to $30,000 and stays there, you must record a $10,000 impairment loss.

5. Revenue recognition for crypto

When your business receives crypto as payment:

- Recognize revenue based on the fair market value (FMV) at the time of receipt.

- That FMV becomes the cost basis for the asset if held.

- Future changes in value affect capital gains/losses, not revenue.

Example: You sell a product for 0.1 BTC. On the date of sale, 0.1 BTC = $5,000. You record $5,000 in revenue. If you later sell the BTC for $6,000, you realize a $1,000 capital gain.

6. Non-cash asset management

Crypto is a non-cash asset, even if it’s liquid. Businesses must:

- Segregate crypto holdings from cash accounts.

- Track them by wallet and blockchain address.

- Reconcile balances regularly.

- Assign internal controls (e.g., multi-signature wallets) to reduce fraud.

Pro tip: Treat your crypto like inventory: tracked, documented, and regularly reconciled with internal ledgers.

7. Auditability and proof of ownership

Blockchain is transparent—but your business must still:

- Maintain internal records matching blockchain transactions.

- Provide wallet ownership evidence (screenshots, keys, custodial agreements).

- Use blockchain explorers to verify TXIDs during audits.

Remember: Crypto accounting is auditable—but only if your records are consistent and complete.

8. Multi-jurisdiction compliance

If your business operates globally or accepts crypto internationally:

- Track local tax laws (capital gains, VAT/GST rules, etc.).

- Understand how different regulators (IRS, CRA, HMRC, ATO) treat crypto.

- Convert all crypto values to local fiat currencies for each jurisdiction’s reporting.

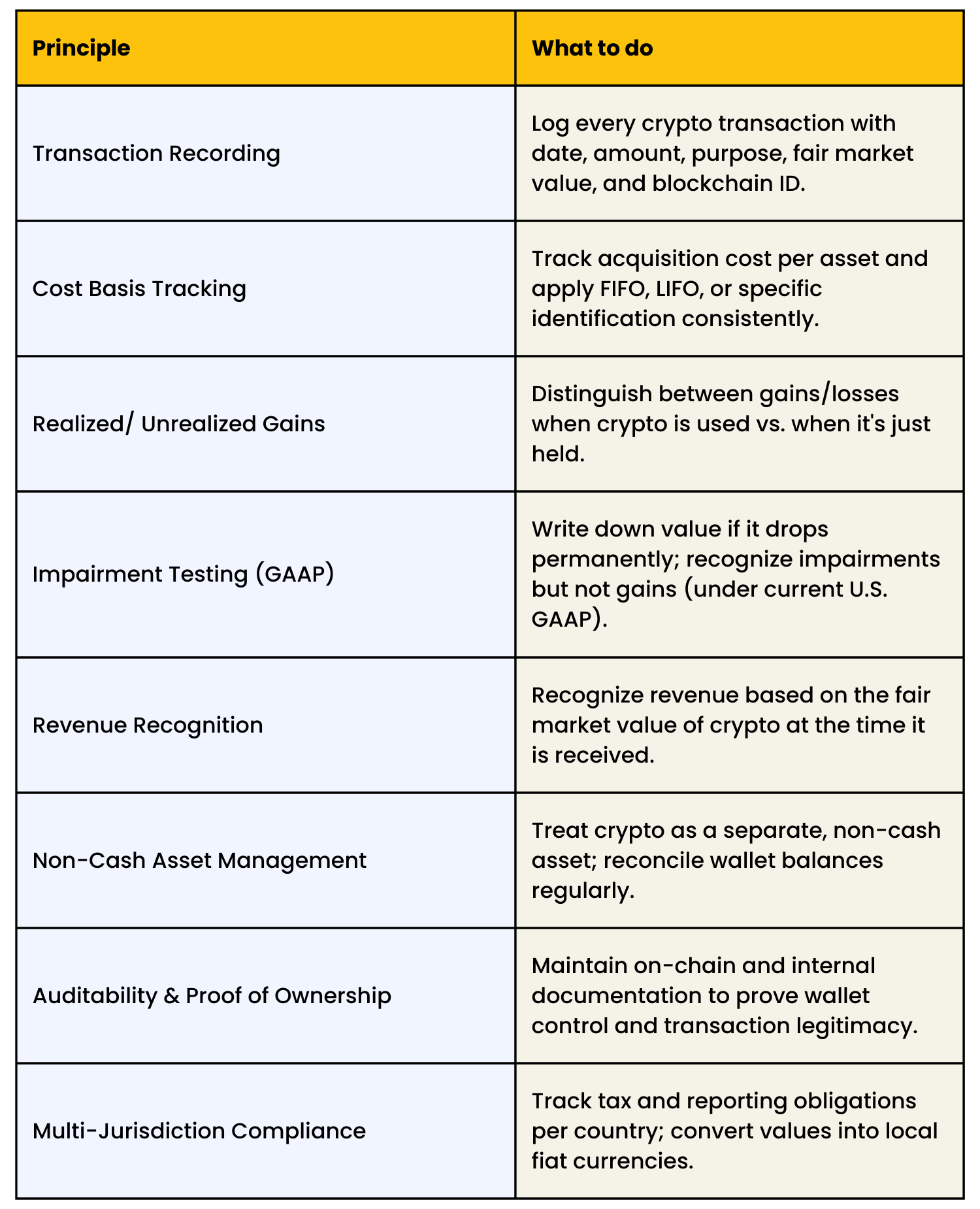

Summary of core accounting principles for crypto

Best practices for cryptocurrency accounting

To stay compliant and efficient, businesses should:

1. Track everything

- Use crypto accounting tools to auto-sync wallets and exchanges.

- Maintain clean logs for each transaction.

2. Choose the right valuation method

- Common methods:

- FIFO (First-In, First-Out)

- LIFO (Last-In, First-Out)

- Specific Identification

- Stay consistent year over year unless formally changing your accounting policy.

3. Reconcile regularly

- Compare internal records with:

- Blockchain explorers

- Exchange APIs

- Wallet balances

4. Separate personal & business accounts

- Use dedicated business wallets.

- Avoid mixing assets to simplify auditing and tax filings.

5. Use purpose-built tools

- Use Koinly, Bitwave, CoinTracker, Cryptio for accounting and tax reports.

- Utilize QuickBooks and Xero plugins for integration.

6. Work with crypto specialists

- Choose a partner who knows SEC, IRS, and international crypto standards.

Checklist for businesses using crypto

Use this checklist to assess whether your business is managing digital assets responsibly and in line with best practices:

- Are all transactions recorded with time stamps and fair market value?

- Is cost basis tracked for each crypto asset?

- Are crypto holdings reported on the balance sheet?

- Are capital gains/losses properly calculated?

- Are you using crypto-friendly accounting software?

- Have you consulted a crypto-savvy CPA?

- Do you have a policy for wallet security and audit readiness?

Want us to evaluate your crypto compliance? Book a free audit readiness consultation with Smart Accountants today.

Final thoughts

Cryptocurrency can offer enormous benefits—fast payments, global reach, asset diversification but only if it’s managed with sound accounting practices. Business owners must view crypto not just as a technical novelty, but as a core financial responsibility.

Whether you’re accepting Bitcoin payments, investing in Ethereum, or launching an NFT-based product, mastering crypto accounting ensures you’re operating legally, transparently, and profitably.

Need help with crypto accounting?

Let Smart Accountants simplify the complexity. From transaction tracking to tax filing — we’ve got your back. Book a free consultation today.

FAQs

1. What is cryptocurrency accounting and why is it important for businesses?

Cryptocurrency accounting refers to tracking, recording, and reporting digital asset transactions like Bitcoin, Ethereum, or stablecoins on your financial statements. It’s crucial for legal compliance, tax accuracy, investor transparency, and avoiding penalties from regulatory bodies like the IRS or HMRC.

2. How cryptocurrencies classified in business accounting?

Under current U.S. GAAP and IFRS guidelines, cryptocurrencies are usually classified as intangible assets, not cash or inventory. This affects how gains, losses, and impairments are recorded on your balance sheet and income statement.

3. Are crypto transactions taxable for businesses?

Yes. Most cryptocurrency transactions are taxable events. Selling, trading, or using crypto for payments can trigger capital gains or income taxes depending on the jurisdiction. It’s essential to track cost basis and fair market value for accurate reporting.

4. What’s the biggest mistake businesses make in crypto accounting?

The most common mistake is failing to track the fair market value at the time of each transaction. Many businesses only record the crypto amount (e.g., 1 BTC) without converting it to local currency, leading to inaccurate revenue, tax reporting, and capital gains calculations.

5. Do crypto-to-crypto trades need to be reported?

Yes. Trading one cryptocurrency for another (e.g., BTC for ETH) is a taxable event in many jurisdictions, including the U.S. You must report both the disposal of the old asset and the acquisition of the new one, using fair market values at the time of the trade.

6. What happens if a crypto asset is lost or stolen?

Losses from theft or loss of access (e.g., lost private keys) may be deductible, depending on jurisdiction. In the U.S., these are generally only deductible if related to a business and proven to be unrecoverable. Keep documentation for all events leading to the loss.

7. How can Smart Accountants help with cryptocurrency accounting?

Smart Accountants offers expert crypto accounting services tailored for businesses. We handle everything from transaction tracking and cost basis calculations to compliance with IRS and international tax laws—ensuring your records are audit-ready and fully compliant.

8. How does Smart Accountants stay updated on cryptocurrency regulations?

Smart Accountants constantly monitors changes in cryptocurrency regulations globally and works closely with legal and compliance experts to ensure your business stays ahead of any new rules or tax obligations.